01 Korean media: Samsung is unlikely to join Micron’s chip production cuts

According to the analysis of the Korea Times on the 26th, although Micron and SK Hynix have begun to save costs on a large scale to cope with the decline in revenue and gross profit margins, it is very unlikely that Samsung will change its chip production strategy. By the first quarter of 2023, Samsung will basically still manage to maintain its gross profit margin, and it is predicted that consumer confidence will recover as soon as the second quarter.

A senior senior executive of a Samsung supplier revealed in an interview that Samsung is trying to reduce chip inventory. Although the reduction in production is bound to benefit the short-term supply and demand situation, Samsung does not seem to consider significantly reducing storage output because the company is still working with important customers such as automakers. Discuss how to restore inventory to health. The person said that the technology introduction and installation actions of the American foundry will be the focus of Samsung. He said that Samsung does have a very high probability of adjusting storage capacity, and the time to decide to invest in equipment depends on the progress of chip inventory.

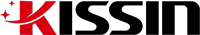

02 176-layer 4D NAND, SK hynix will demonstrate high-performance memory at CES 2023

SK hynix said on the 27th that the company will participate in the world’s largest electronics and IT exhibition – “CES 2023″ to be held in Las Vegas, USA from January 5th to 8th next year, to showcase its main memory products and new products. line-up.

The core product displayed by the company this time is the ultra-high-performance enterprise-level SSD product PS1010 E3.S (hereinafter referred to as PS1010). PS1010 is a module product combining multiple SK hynix 176-layer 4D NAND, and supports the PCIe Gen 5 standard. The technical team of SK Hynix explained, “The server memory market continues to grow despite the downturn. Compared with that, the read and write speeds have increased by up to 130% and 49% respectively. In addition, the product has an improved power consumption ratio of more than 75%, which is expected to reduce customers’ server operating costs and carbon emissions. At the same time, SK Hynix will showcase a new generation of memory products suitable for high-performance computing (HPC, High Performance Computing), such as the existing highest performance DRAM “HBM3″, and ” GDDR6-AiM”, “CXL memory” that flexibly expands memory capacity and performance, etc.

03 The Korean version of the “Chip Act” was passed amid criticism, all because of too little subsidies!

According to South Korea’s “Central Daily” report on the 26th, the South Korean National Assembly recently passed the Korean version of the “Chip Act” – “K-Chips Act”. It is reported that the bill aims to support the development of the Korean semiconductor industry and will provide incentives for key technologies such as semiconductors and batteries.

The report pointed out that although the final version of the bill increased the tax credit for investment expenditures of large enterprises from 6% to 8%, the overall reward amount was significantly regressed compared with the draft proposed by the ruling and opposition parties, which attracted criticism: the bill The influence on the improvement of South Korea’s key technology is greatly reduced. It is reported that the official name of the Korean version of the “Chip Act” is the “Restriction of Special Taxation Act”. On the 23rd, the South Korean National Assembly passed the bill with 225 votes in favor, 12 votes against, and 25 abstentions. However, the Korean semiconductor industry, business circles, and academic circles collectively expressed criticism and opposition on the 25th. They said, “If this continues, we will usher in an ‘ice age of the semiconductor industry’” and “the plan to train future talents will come to naught.” In the version of the bill passed by the National Assembly, the scale of tax relief for large companies such as Samsung Electronics and SK Hynix was increased from the previous 6% to 8%. Not only did it fail to reach the 20% proposed by the ruling party, but even the 10% proposed by the opposition party. If it is not reached, the scale of tax reduction and exemption for small and medium-sized enterprises will remain unchanged at the original level, at 8% and 16% respectively. Before South Korea, the United States, Taiwan, the European Union and other countries and regions have successively introduced relevant bills. Relatively speaking, the subsidies in these countries and regions are as high as double-digit percentages, and the level of subsidies in mainland China has attracted much attention. It is no wonder that South Korea has criticized the bill for insufficient subsidies.

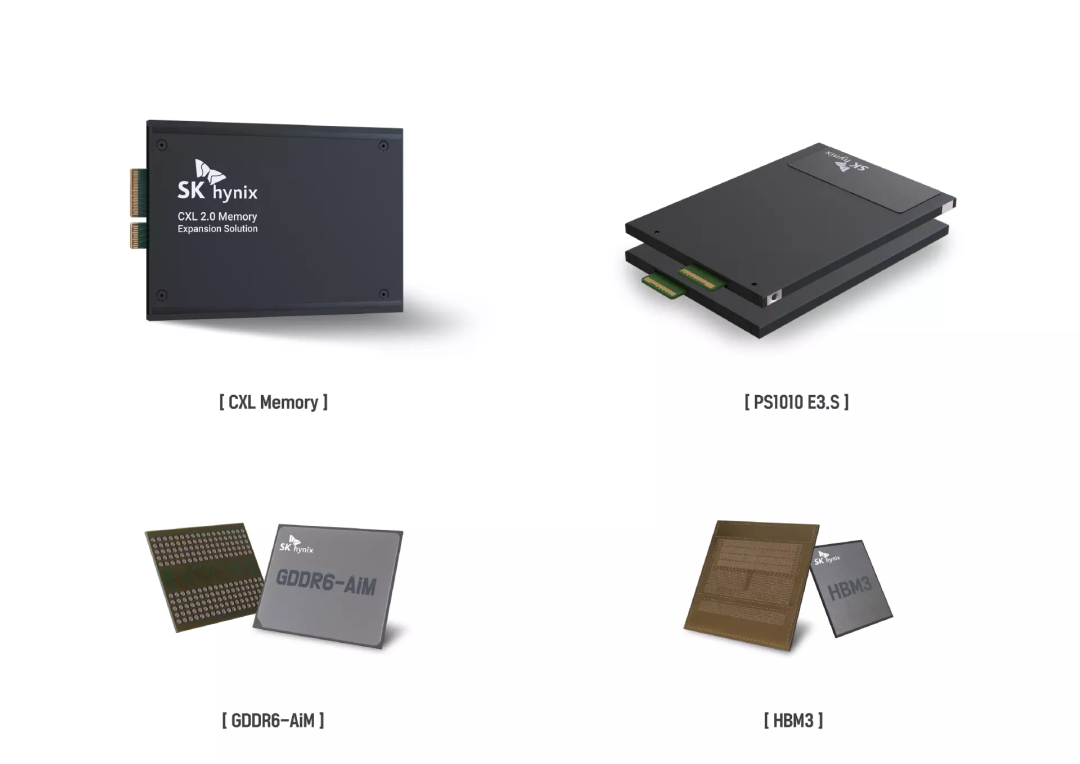

04 Agency: India’s smartphone market fell short of expectations this year, down 5% year-on-year

According to the latest research from Counterpoint, smartphone shipments in India are expected to fall by 5% year-on-year in 2022, missing expectations.

And the culprit for the decline in shipments is not all parts shortages, because the supply situation in the first half of 2022 has actually been resolved. The main reason for limiting shipments is insufficient demand, especially for entry-level and mid-range phones that are more cost-sensitive. However, unlike the depression of the above two types of markets, the high-end market will be the growth point in 2022. In fact, according to Counterpoint’s data, shipments in the price range of more than $400 hit a record high. At the same time, the sales of high-end mobile phones have also driven The average price rose to a record close to 20,000 Indian rupees (about 250 US dollars). However, considering that there are still a large number of feature phones and mobile phones using old communication standards in the Indian market, in the long run, the replacement needs of these stock users will become the driving force for the smartphone market in the future.

05 TSMC Wei Zhejia: The utilization rate of wafer foundry capacity will only pick up in the second half of next year

According to Taiwan media Electronics Times, recently, TSMC President Wei Zhejia pointed out that semiconductor inventory peaked in the third quarter of 2022 and began to be revised in the fourth quarter. . In this regard, some manufacturers said that the last line of defense in the semiconductor industry chain has been broken through, and the first half of 2023 will face severe challenges of inventory correction and performance collapse.

According to industry observations, the capacity utilization rate of second-tier wafer foundries has begun to decline since the third quarter of 2022, while TSMC has begun to decline since the fourth quarter, and the decline will increase significantly in the first half of 2023. In the peak season of goods, the proportion of 3nm and 5nm orders has increased, and the performance is expected to rebound significantly. Except for TSMC, wafer foundries whose capacity utilization rate and performance have been declining are more conservative and cautious about the outlook for 2023. It is estimated that most of the overall supply chain in the first half of the year will still be difficult to get out of the inventory adjustment period. Looking forward to 2023, TSMC is facing challenges such as dilution of gross profit in the initial stage of mass production of the 3nm process, rising annual growth rate of depreciation costs, cost increase caused by inflation, semiconductor cycle and expansion of overseas production bases. TSMC also admitted that starting from the fourth quarter of 2022, the utilization rate of 7nm/6nm capacity will no longer be at the high point of the past three years. pick up.

06 With a total investment of 5 billion, the main project of Zhejiang Wangrong Semiconductor Project has been capped

On December 26, the semiconductor project of Zhejiang Wangrong Semiconductor Co., Ltd. with an annual output of 240,000 pieces of 8-inch power devices was capped.

Zhejiang Wangrong Semiconductor Project is the first 8-inch wafer manufacturing project in Lishui City. The project is divided into two phases. The first phase of the project is capped this time, with an investment of about 2.4 billion yuan. It is planned to be put into operation in August 2023 and achieve a monthly production capacity of 20,000 8-inch wafers. The second phase will start construction in the middle of 2024. The total investment of the two phases will reach 5 billion yuan. After completion, it will achieve an annual output of 720,000 8-inch power device chips, with an output value of 6 billion yuan. On August 13, 2022, the groundbreaking ceremony for the project was held.

Post time: Dec-29-2022