Two conferences are being held in the capital, and the 5% growth target set this year is relatively conservative, which is obviously a helpless manifestation of the reality of economic difficulties.

Against the background of the overall poor environment, the performance of the storage market this week is even more worrisome after the previous period of continuous decline.

Whether it is Micron’s poor performance that may lay off more employees, or the overall semiconductor industry’s soaring chip inventory data in South Korea, which relies heavily on storage, it has become so bad that there is no need to say more.

In terms of module factories and terminal demand, there are also news that Macronix’s revenue in February fell by more than 40% year-on-year, Jinghaoke lost NT$800 million in inventory prices, and enterprise SSD revenue fell by nearly 30% in Q4 last year.

In summary, the current situation of “winter is coming” in the storage market has basically taken shape. In addition, SSD master control manufacturers have made a big move to clear inventory, and the vicious circle of poor market conditions and cold demand has become a significant risk that all storage people have to be vigilant enough to.

In contrast, the news that Winbond and ADATA recorded revenue growth of more than 10% month-on-month in February still seems to be weak.

SSD solid state market

This week, the overall SSD market is still in decline, with little order demand and no change in transaction volume. Following the reduction of original chip wafers, controllers have also been officially included in the inventory clearance, with a reduction of about 30%. Some industry insiders pointed out that, except for the increase in inquiries in the server market, other consumer markets are suffering, and it is time for a real test. The falling will only make the demand worse, and the market without demand will only get worse, entering a vicious circle of internal friction. I urge everyone to treat it rationally, and don’t operate without a limit!

This week, NVME roughly quoted, and all capacity showed a downward trend, with a decline of about 1%-2%;

OEM PCBA: around 85/126/245/630.

This week’s SATA 3.0 market quotations, all capacities are in a downward trend, with a decline range of about 1%-4%;

OEM PCBA: 120G/240G/480G/960G/2T Quotation (without packaging, etc.): 40/70/120/240/530

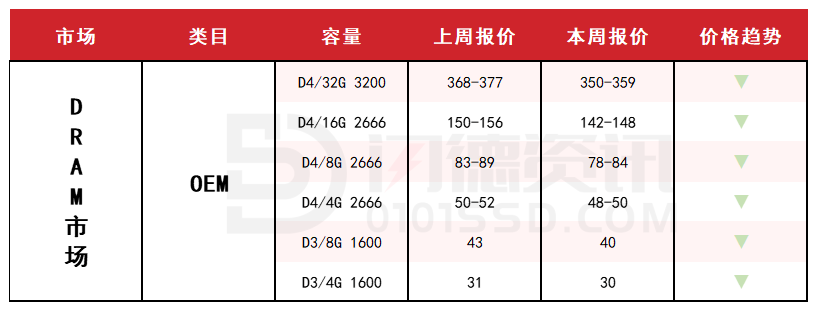

DRAM memory market

The DRAM market is still poor this week, the overall market price continues to fall, the transaction volume is also shrinking, and the demand is very weak. It is not suitable to increase the inventory in the near future, and the one-to-one operation is the main one.

This week, memory OEM market quotes show a downward trend in all capacities, with a decline range of about 4%-6%. In the D3 sector, all capacities are in a downward trend, with a decline range of about 3%-7%.

Brand quotation: (the price is for reference only, the market fluctuates)

D4 2666 32G: 375-452

D4 2666 16G: 164-211

D4 2666 8G: 86-110

D4 2666 4G: around 60-91.

FLASH particle market

The spot market of FLASH particles was quiet this week, and the price continued to fall. The quotation of the original wafer, the quotation of 128G/64GTLC Good Die wafer is about 3.4/1.8 US dollars, the actual transaction price is lower, and the overall oversupply remains unchanged. The terminal is sluggish, and traders wait and see, basically in a one-on-one state. Don’t think too much at the moment, keep the one-to-one operation, and it is not suitable for inventory.

USB 2.0/USB 3.0/TF card market

This week, the USB market price is still falling slowly, the demand is still not improving, and there is still room for decline in large capacity. There are no large shipments of granules, Good Die wafer contract prices continue to drop, and traders continue to wait and see the flow.

This week, PCBA’s general quotations, except for 4G and 128G capacities, are in a downward trend, with a decline range of about 1%-3%;

UDP is roughly quoted this week, so the capacity is in a downward trend, and the decline range is around 1%-4%;

This week, the USB 3.0 market is roughly quoted, and all capacities are in a downward trend, with a decline range of about 1%-4%;

This week, the TF card market generally quoted prices. Except for the 64G capacity, the other capacities showed a downward trend, and the decline range was around 2%-3%.

Post time: Mar-13-2023